Hapag-Lloyd, the world's fifth-largest liner company, announced strong results for the first half of 2022 on Thursday and forecast the outlook for container shipping: demand is slowing, spot freight rates will continue to fall, and the current very serious congestion will have alleviated. But demand has not collapsed. Some areas, such as the U.S. East Coast, are experiencing more congestion than others. From 2023 to 2024, the supply of ship capacity will exceed the demand for freight.

▎Strong performance in the first half of the year

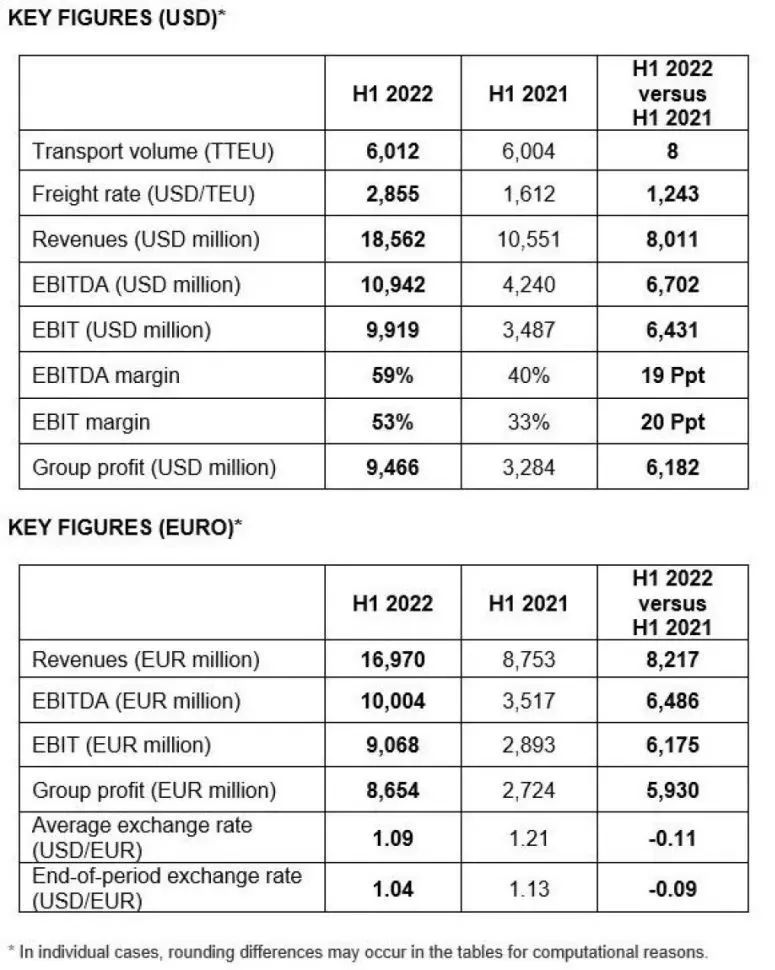

Hapag-Lloyd achieved operating income of US$18.562 billion in the first half of this year, a year-on-year increase of 75.9%; net profit was US$9.466 billion, a year-on-year increase of 188.2%; earnings before interest, tax, depreciation and amortization (EBITDA) was US$10.9 billion, a year-on-year increase of 159% %; earnings before interest and taxes (EBIT) were $9.9 billion, up 182% year over year. Cargo volumes in the first half of 2022 were flat year-over-year at around 6 million TEU.

▎Container transportation demand

"U.S. consumers seem to be doing pretty well," Hapag-Lloyd Chief Executive Rolf Habben Jansen said on a conference call on Thursday. "If you look at the first half of the year, transpacific volumes are growing (year-on-year), which is very significant given the massive growth seen in 2021 compared to 2020."

Chief Financial Officer Mark Frese said: "Right now, the market is focusing on weak demand. Despite this bad news, demand remained strong during the reporting period (the second quarter)."

"We're seeing steady demand in the U.S., but more tension and uncertainty in Europe and some other regions," Habben Jansen said of import demand, which was more than halfway through the third quarter as of Thursday. Demand has fallen off a cliff.”

However, he did see a "considerable relief in demand" compared to the peak. "We will definitely see signs of a cooling economy that will help the market return to normal in the months and quarters ahead."

“In the past, we had multiple times overbooking on each of our shipping systems, and it’s still overbooking, but not as strongly. That’s why spot rates are down. That’s not to say there aren’t any tensions, but it’s true There are signs that the market is easing. We can see that in bookings and offers," Habben Jansen said.

▎Container spot freight rate

Hapag-Lloyd's average container freight rate in the second quarter of 2022 was US$5,870/FEU, an increase of 71% over the same period last year and the highest quarterly average freight rate ever recorded.

Compared with the first quarter, its average freight rate rose 6% quarter-on-quarter, while the Shanghai Container Freight Index (SCFI), which measures spot freight rates, fell 26% over the same period. The rise in Hapag-Lloyd's average freight rates was driven by higher annual and multi-year contract rates, Frese said.

According to Habben Jansen, 45%-50% of Hapag-Lloyd's business is conducted under contract. He expects the remaining 50%-55% of spot freight rates to continue to fall in the second half of the year, though he noted that "spot freight rates are still very high by historical standards."

Hapag-Lloyd's full-year guidance implies that contract rates will continue to support its average rates. Hapag-Lloyd expects EBITDA of $8.6 billion to $10.6 billion in the second half, with a stronger third quarter than the fourth. The upper end of its second-half expectations is close to a record first-half EBITDA of $10.9 billion, implying continued strength in the market.

"The exceptional freight environment continued to be the main driver of our performance," Frese said.

▎Congestion has eased in some ports, but not on the East Coast

Port congestion is helping support freight rates by stranded ships and reducing effective capacity in the freight market.

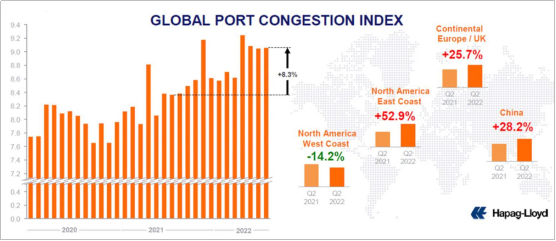

Clarksons' container traffic congestion index is now near an all-time high. According to Hapag-Lloyd, the congestion index on the US East Coast in the second quarter of 2022 was up 53% from the first quarter, with China up 28%, Northern Europe up 26%, and the US West Coast down 14%.

Container congestion (in millions of TEU); 7-day shipping average (Graph: Hapag-Lloyd; Data: Clarkson SIN)

"I don't think that tells the full story," Habben Jansen said.

“We do see some signs of easing. Congestion on the west coast of the US has improved significantly. The Mediterranean is running fairly smoothly. Congestion in Asia has improved significantly compared to a few months ago. Container availability is significantly better than a few months ago. As a result, I expect this congestion index to improve in the coming months.”

Habben Jansen said: “The real problem now is on the US east coast and in Europe (north). Congestion in the east has not worsened, but it has not improved. Congestion at European ports is caused by labor tensions at some of the larger ports. This issue is resolved and I expect further mitigation."

▎In 2023-2024, cargo shippers will dominate

When congestion finally eases, more ships will enter the market. In 2023-2024, a wave of newbuilding deliveries will inject even more capacity.

The CEO of Hapag-Lloyd said: “We are seeing a further increase in the order book for new ships. Currently, it accounts for about 28% of the global fleet (the ratio of ordered capacity to existing capacity), which is quite high. This is a very important order, which means we will get quite a few new ships in the future."

"How much of this will be absorbed by demand or absorbed by new environmental regulations, or offset by increased scrapping of ships, remains to be seen," he said. "New environmental regulations may effectively require reduced sailing speeds, which may be in place in 2023-2024. Reduce annual capacity by 5%-10%.”

Overall, Hapag-Lloyd expects the future market balance in container shipping to favor freight shippers. After years of import demand outpacing capacity supply, the report estimates that global fleet capacity will grow by 7% by 2023, more than double the 3% increase in demand.

“We clearly see that capacity supply growth will outpace demand growth over the next 24 months,” Habben Jansen said.

Separately, Rolf Habben Jansen said he would make more acquisitions in the container industry if the right opportunity presented itself. Hapag-Lloyd has also commissioned 12 newbuilding orders of 23,600 TEU, ready to use liquefied natural gas (LNG), and five container ships with a capacity of around 13,000 TEU. In addition to the two ships that will be delivered this year, the rest of the new ships will be delivered over the next two years.

Previous:Another new shipping company was established! Mainly focus on trans-Pacific route services

Next:The owner bought it! 4 3000TEU container ships built by Taiwan Ships have been finalized by buyers