The latest has been thinking about a question, what does the new normal of the US line look like?

The madness of 2021 is far from us, and 2022 is over halfway through various expectations, changes, and anxiety. What will happen next? What does the future look like?

The madness of hard-to-find warehouses and high shipping costs has ended, and the once-in-a-century pomp of last year is unlikely to happen again. Due to the sluggish cargo volume, the freight rate is still dropping, and the market spot price has fallen by 50% compared with the beginning of the year. Standing at the port of departure, the market is bleak, it is mid-August, and there is no feeling of peak season. However, there have been frequent reports of good news from US terminals recently, and the import volume in June has reached a new high. The second-quarter profit announced by the shipping company has achieved another success. Many shipping companies have significantly raised their profit expectations for this year. In 2022, the annual profit of the main shipping company will far exceed that of last year.

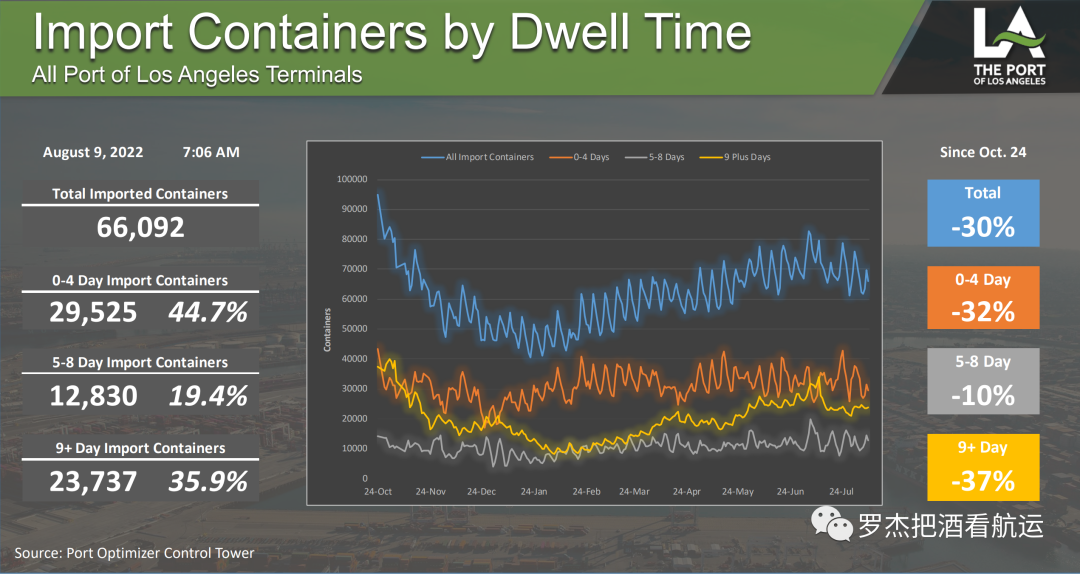

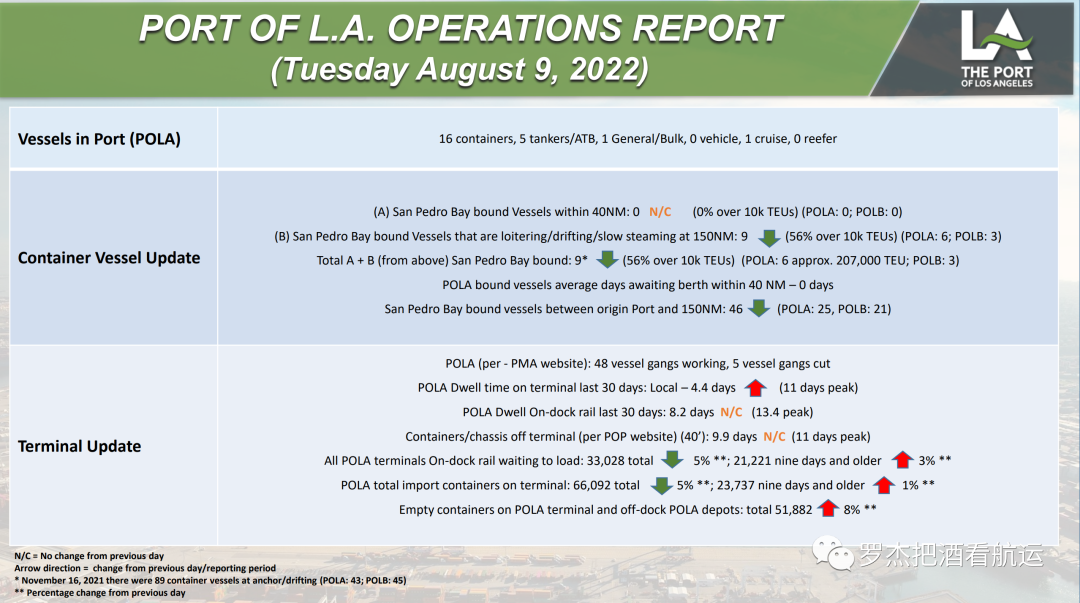

Meanwhile, congestion on the U.S. side has not improved, and while the number of ships waiting on the West Coast has dropped to 2020 levels, the congestion in the terminal yard is worse than in the third quarter of 2021. On Wednesday, 36% of imported boxes at the Los Angeles terminal stayed for more than nine days, the highest proportion in the past six months, and more and more boxes entered the closed area after unloading. The worst is the IPI cabinet, up to two-thirds of the ondockIPI cabinets stay longer than 9 days. These two most important indicators of terminal yard mobility clearly show that the congestion on the US side is far from over, although the number of ships waiting at LA/LB has dropped below 10 for the first time, even less than in 2020. . At the same time, the situation was worse at the Vancouver Wharf in the north and the Canadian IPI, and the number of ships waiting in the US East reached new highs.

In a volatile market, various types of information seem to contradict each other. Is the current low season or peak season? The old era is over, and the new era is still finding its way in the turmoil. What will happen next? What does the new normal of the market mean for players of all parties? We discuss it from the following four perspectives.

Supply and demand

As I said before, the supply of U.S. line capacity is open and transparent. Several routes, several ships, the size of each ship, these are public information. The variable comes from the gap between nominal capacity and effective capacity. Last year's congestion is the best proof. Ships are trapped by the congestion of the wharf, the turnover is slow, the same number of ships run fewer voyages a year, and the actual capacity is reduced. The loss of capacity due to congestion last year is generally estimated to be around 15-20%, which is a considerable proportion and one of the important reasons for the difficulty in finding a warehouse.

At present, the waiting time of ships has been greatly improved. Judging from the largest port area LA/LB, the waiting time for berthing has increased from a few months last year, to 10-14 days at the beginning of the year, and then to about 3 days now, and the turnover of ships has improved. Oakland terminals have been hit by a week of driver strikes, with longer wait times. Due to the increase in cargo volume at the docks on the east coast, the waiting time of ships is also getting longer. If there is no strike at the US West Terminal (it seems that there is a high probability that it will not), the cargo volume will not increase significantly, the waiting situation of ships will not continue to deteriorate, and more capacity will be released.

The demand side is the hardest to predict. U.S. consumption has been transformed, and at the same time, it is still in the channel of raising interest rates. On the one hand, consumption has returned to services; on the other hand, food and oil prices have risen dramatically, and low- and middle-income households have been forced to adjust their consumption, while consumption of non-essential goods has declined.

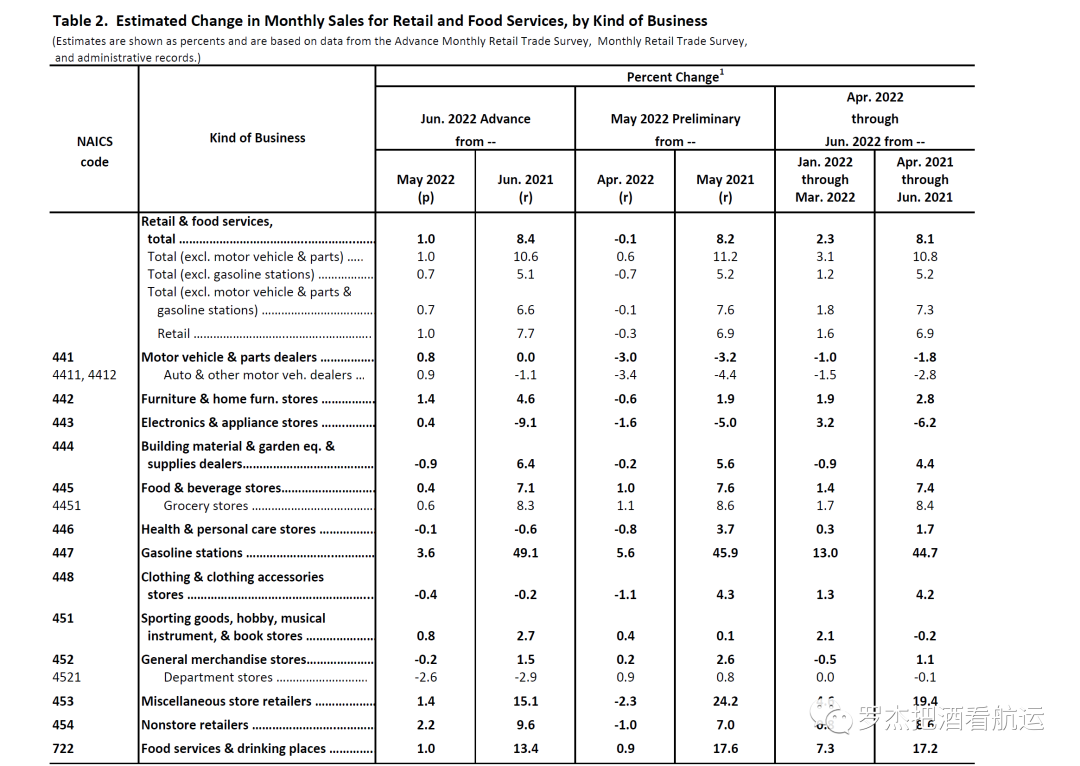

Two data released by the USCB (U.S. Census Bureau) on July 15 further confirmed everyone's judgment on the transformation of American consumption. Total retail sales in June increased by 1% month-on-month, reversing a month-on-month decline in May. From the perspective of specific commodities, building materials, health supplies, clothing, and general merchandise saw a month-on-month decline in sales, and electronic products, electrical appliances, health supplies, clothing, and general merchandise saw a year-on-year decline in June last year. Interestingly, the consumption of furniture has maintained a year-on-year and month-on-month growth, which is a bit unexpected (the reason for the price reduction?). Another category that keeps growing is the sporting goods category. However, both department stores and clothing consumption fell, which is consistent with the profit warning issued by major department stores a while ago.

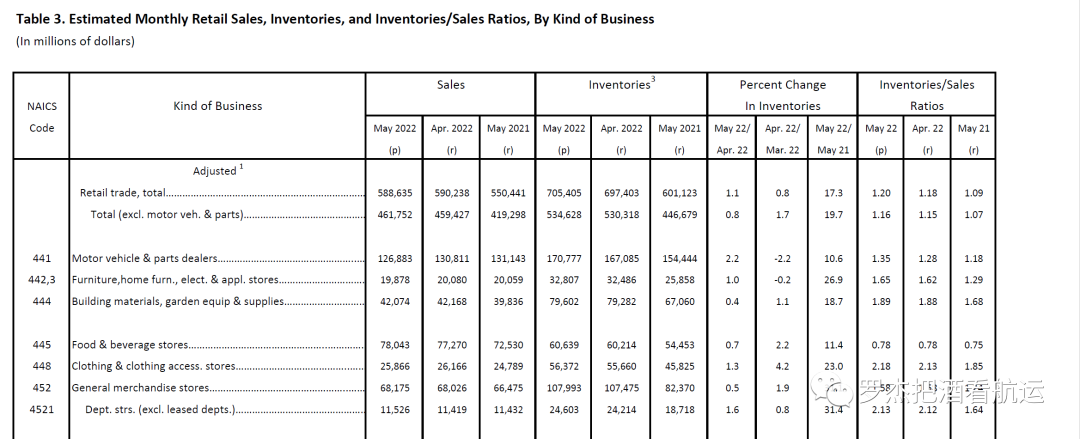

The latest data on the retail inventory-to-sales ratio is only in May. Although the overall proportion is still low, only 1.2, which has risen a lot from 1.09 in the same period last year. From the perspective of a single category, in addition to automobiles and auto parts, the inventory-to-sales ratios of furniture, electrical appliances, building materials, clothing and general merchandise, which account for the largest proportion of US imports, have all approached or even exceeded the level before the epidemic, and far exceeded the level in May last year. More importantly, the month-on-month increase in May showed that the pressure of "destocking" is still there.

For the reasons mentioned above, there is little chance of a substantial increase in US physical consumption in the second half of the year. At the same time, consumption transformation is also a gradual process, not a cliff-like decline. The price reduction and promotion of the epidemic-selling products with excessive inventory will continue, and the normal seasonal consumption will continue. This is in stark contrast to the reckless purchase in the second half of last year. Therefore, the latest NRF (National Retail Federation) report that US retail imports from August to December are almost all single-digit declines (August -3%, September + 0.4%, October -3.9%, November -2.7%, December -3%), which was also in line with expectations. The base number in the second half of last year was too high, and a correction from a high level is inevitable, after all, the consumer market has changed.

From January to July this year, US imports from Asia increased by 4%. Assuming a 3% year-on-year decline in August-December, imports from Asia for the full year of 2022 will increase slightly by 1% compared to last year. It can be said that the best forecast for the US line volume in 2022 is to be the same as that in 2021.

persistent congestion

The volume of goods and freight rates are sluggish, but the congestion is getting worse and worse. The congestion level of the West American terminal yard has approached or even exceeded the third quarter of last year, especially IPI's cabinets, and the delay level is reminiscent of last year's "nightmare". Congestion at U.S. eastern ports is at its worst this year. At one point last week, the number of ships waiting at the port of Savannah exceeded 40.

At first glance, it's a bit puzzling: there are few goods, why is it still so blocked? This problem can be understood in this way. Congestion on the US side is lagging and a cumulative process. The focus of the port of departure is the shipping space and the freight rate. These two points reflect the current market changes in real time, and the feeling is very direct. At present, the market volume is less, the shipping space is loose, and the freight rate has dropped, which is completely off-season. However, the current congestion at the destination port is caused by the slow backlog of goods shipped a few months ago. The congestion seen in August was caused by the continuation and accumulation of shipments that began in April. Similarly, because congestion has a hysteresis effect, the elimination of congestion does not happen overnight. Taking IPI as an example, even if shipping companies drastically cut IPI bookings from August (which is unlikely to happen), the congestion at inland stations will not improve immediately. If the ratio of IPI cargo remains the same, the congestion of IPI will continue in the next few months.

Regarding congestion, a basic judgment is that as long as the overall import volume exceeds the handling capacity of the onshore infrastructure, congestion is almost inevitable. Onshore infrastructure includes terminals, fleets, carriages, warehouses, train and rail yards. The only change is at which node the congestion occurs. From last year to now, the same script has been repeated, the pier is blocked, it is transferred to the inland, and the inland is blocked, and then it is transferred back to the dock. The west of the United States was blocked, and the ship was diverted to the east of the United States. As a result, the east of the United States was also blocked. The dockyard is full, and then the warehouse is full, so the dockyard is fuller. There's nowhere to put more cargo than the infrastructure can handle, and it's like a game of whack-a-mole that always resurfaces somewhere. This is expected to continue into the fourth quarter of this year, barring a sharp drop in volumes.

Wrestling between players in different markets

In such a market where the old normal is not completely over and the new normal is not finalized, let's analyze the situation of three major players: shipping companies, cargo owners, and freight forwarders.

Let's first look at the situation of the shipping company (here refers specifically to the main shipping company, and the new shipping company says it separately). In a nutshell: this has been a good year. Recently, major shipping companies have announced their results for the first half of the year. Net profit has increased by more than 50% year-on-year. Many companies have raised their full-year profit forecasts. The full-year profit is higher than the record 2021.

This is another piece of information that seems to be very contradictory to everyone's feelings. In fact, it is not difficult to understand. About half of the cargo on the US line is booked at the contract price. Since the contract was signed early this year, some customers have booked at the new contract price since January. Second, and most importantly, the contract price this year is 2-3 times that of last year. Although not all customers completed their new contracts in February, compared with previous years, in the first half of this year, a considerable part of the cargo volume was booked at a freight rate twice higher than last year. At the same time, the other half of the goods booked at the spot market rate also basically maintained the freight rate in the fourth quarter of last year before June. Compared with the first half of last year, both the contract price and the spot price (which only started to surge in the second half of last year) were much higher from January to June this year. It is not surprising that the revenue and net profit of shipping companies have increased significantly.

The first half of the money has been pocketed, what about the second half? Simply put, it's not bad. The negotiated price is partly affected by the current spot price, and it has already been inverted. It will be the mainstream for the shipping company to lower the negotiated price to ensure the booking space. However, no matter how lower the negotiated price is, it is impossible to reach the negotiated price level of last year. From 8500 to 6000, it is still much higher than last year's 3000. Each shipping company has a different price ratio. From the perspective of the entire market, more than half of the cargo will be booked at a high negotiated price. The remaining question is how far the spot price will fall, which we leave to the next section.

Here I would like to mention the new shipping company of the US line. When the US-West freight rate fell below 6,000, the main shipping companies had no pressure, which was a big test for new shipping companies, especially those with high charter prices. The good news is that compared to the fourth quarter of last year, waiting times (especially in LA) are now significantly shorter, vessel turnaround times are faster, and oil prices are falling. The market freight rate is still dropping, which will greatly test the management level and long-term determination of the new shipping company.

If the ship owner is in a good position, the same is difficult to apply to the cargo owner. Last year, the owner of the goods was not afraid of a lot of shipments, but he was afraid that he would not be able to go out, and there would be no goods to sell by then. However, this desperate act of sending and restocking began to slow down after the year, until importers realized that the inventory was too high. The sharp turn from "restocking" to "destocking" means a change in the situation of cargo owners.

For importers, the biggest challenge is quickly adapting to the changing consumer market. Find ways to reduce overstocked inventory, and decide on the types and quantities of goods to be brought in this Christmas. "Destocking" takes time, warehousing costs increase, and sales profits decrease. At the same time, there are still many unfavorable factors in the consumer demand in autumn and winter, and it is also a problem to buy the right amount of goods. The impact of consumption transition and slowdown on various commodities is not the same. This is illustrated by the retail data released by the USCB mentioned above, which results in a different feel for each importer. From a logistics point of view, the current situation is certainly better than last year. Compared with the beginning of the year, the market freight has dropped significantly, and the logistics cost has dropped. The spot freight rate and the contract price are upside down, and the cargo owner is actively negotiating with the shipping company. In terms of timeliness, the market has not fully recovered. The congestion in IPI and the east of the United States is close to the worst last year, and Vancouver in the north is not worrying. However, in general, the shipping space is no longer tight, the freight rate has also come down, and the cargo owner can breathe a sigh of relief. The transformation of US consumption, coupled with the suppression of consumption by high inflation and high interest rates, will not be optimistic about sales in the second half of the year, which will affect orders.

Shippers also face challenges. Compared with last year, what's more terrifying than not being able to deliver is the lack of delivery: importers cancel, postpone or reduce orders because of changes in inventory. Consumption and imports of goods that were big sellers last year have slowed this year, and shipments have plummeted. Consumption price reductions often hurt the shipper, especially e-commerce goods. Due to the slowdown in sales, the cost of inventory increased, the payment collection slowed down, and the capital chain was under pressure. For customers with freight prepaid, lower rates are a good thing. However, the freight is cheaper and the goods are less. The accommodation was loose and the business was difficult, so I started to roll up the cost.

The freight forwarding that bears the brunt of the experience is the most direct. Last year, the era of "profiteering" came to an end, and it returned to the pre-liberation overnight. After the grand occasion, freight forwarders face a series of new challenges. First of all, this year, the proportion of direct passenger bookings of shipping companies has increased, and the flow of goods to the freight forwarding market is relatively small. At present, the negotiated price and the spot price are inverted. In order to maintain the relationship between the supply of goods and customers, the shipping company will probably adjust the negotiated price appropriately, especially for those direct customers with good relationship and large MQC. Therefore, the direct passenger volume lost because of the price difference has not been transferred to freight forwarding on a large scale. The supply of freight forwarding is less, and the competition is more intense. Also, because the shipping space is relatively loose, the freight forwarder cannot add a high profit, but the cost of advancing money has not decreased. For example, the same cost of $6,000 could be sold for $1,000 or more last year. Now it may be $100. The return on capital is terrible. At present, it is the most difficult market for freight forwarders: the freight rate keeps dropping. When the common expectation is that shipping costs will drop, it seems that customers are too expensive to quote any amount. Everyone has a common competitor: a freight forwarder called "Other Freight Forwarding".

Friends who only joined the US line freight forwarding this year feel that they are in the wrong industry. Friends who have been through last year's market are struggling to get used to the "new" normal. Madness is short-lived, dullness is the norm. Last year's carnival temporarily continued the basic freight forwarding model of speculating space and selling price differences. When the market is calm, the competition among freight forwarders will return to a higher level of all-round, full-link service customers. Some took the opportunity to cash out at a high level and left, and some introduced strategic investors to expand their business territory horizontally and vertically. In the case that the space is not tight, the freight rate difference between large and small freight forwarders is not large. Small and refined is the way out, and big and comprehensive is also the way. On the premise of intensive farming services and ensuring timeliness, it is necessary to maintain cost advantages, which is the involution of freight forwarding.

Return to 'normal' for shipping costs

Friends who can insist on seeing here seem to really care about the beauty line. Finally, let's take a look at the freight rate trend that everyone is most concerned about.

Directly ask the question you want to ask: How far will the freight rate drop before it stops? In other words, what is the new normal for US freight rates?

There is no dispute that current freight rates are considered unsustainable by everyone. The fall in freight rates from a high level has already begun and is still continuing. At what price will it stop falling? There seems to be a popular saying in the market: the freight rate of the US line will stop at about $3000 and will not fall again. The CEO of Dexun expressed a similar view a few weeks ago: the new bottom line of US freight rates will be 2-3 times that of 2019. In 2019, the freight rate in the United States and West is around $1500, which is $3000-$4500.

Is this really the stop line? Frankly speaking, such conclusions and predictions have no scientific basis, and are more of a feeling and intuitive judgment. The experience of the past few years tells us that the trend of freight rates is not driven by human will. I clearly remember that when the freight rate in the United States and West exceeds $3000, people generally think that $4000 is a psychological line that cannot be crossed. When the freight rate easily crossed $4000, no one talks about the psychological line anymore.

In the long run, the midline of freight rates depends on the dynamic balance of supply and demand. In the case of expected sluggish demand, dynamic capacity management has the greatest and most direct impact on freight rates. Looking at the current situation, although the congestion on the US line has improved from the worst time last year, it has not fully recovered and is still changing. The lost capacity is not easy to estimate, and it also brings challenges to dynamic capacity management: how much capacity is just right?

The current decline in freight rates is gradual, not sharp. The next 6 weeks may be the last wave of shipments this year. It is unlikely that the freight rate will drop sharply. The worst is a toothpaste-style fine-tuning. It is very likely to stop the decline. Being beaten in the face), it is a good wish for the US-West freight rate to return to the prefix 8. The real challenge is after the National Day. By then, the trade union negotiations between the United States and the West should have reached an agreement, and the dark cloud of the strike will dissipate. The recent abrupt change in U.S.-China relations has made the possibility of removing tariffs confusing. Without the tailwinds, a year-over-year decline in U.S. imports in the fourth quarter is all but certain, as last year's baseline was too high and demand fell this year. At present, the frequency and scale of empty shifts of shipping companies are not radical. When the shipping company foresees that the loading rate is lower than 80%, it is estimated that it will start to increase the empty shift rate. While increasing the loading rate, it is hoped that the freight rate will stop falling. This situation is likely to appear in the fourth quarter of this year. If the cargo volume in the fourth quarter is only slightly down, coupled with dynamic capacity management, the freight rate can slowly decline, and the US and West may be able to maintain 4 by the end of the year.

The current market is the beginning of the end of an old era, not the end of the beginning of a new era. The new normal of the US line is still looking for a new direction and a new balance amid the turbulent changes. Off-peak seasons feel intertwined, with old and new normals overlapping. Sometimes I think that the new normal we are looking forward to may not be a static state. Is the current turbulent and contradictory market the new normal of the US line?

Previous:The owner bought it! 4 3000TEU container ships built by Taiwan Ships have been finalized by buyers

Next:Four factors cause shipping prices to continue to fall